The biggest question on the lips of every crypto investor is, “when is this crypto bull run coming?” In such a hugely manipulated market, retail investors have been absolutely decimated, seeing their investments shrinking from the word go and some people have never, not once, seen any upside to their crypto investments. This tale is very common and is very well known to the smart money, who know exactly how and when to apply pressure on the market to extract all the dumb money from emotional, inexperienced investors. Think of it as a see saw, when a market is going up, the smart money is in, when a market is going down, its because the smart money are liquidating its positions, but the point is, the smart money is always on the right side of the trade, so the aim is to be on the right side of the trade with them.

A huge bull run in the crypto market is just around the corner, all of the foundations are being laid and the deals are being done with very little media attention as the elite allow the crypto mania to die down while getting ready to open their positions at their preferred prices. One thing is for certain, everything happening in the market is planned by the elite, there are groups of individuals who know exactly where the market is heading, and these are the guys who have had their money in one of the longest bull runs in stock market history, eventually a lot of this money will flood into crypto and kick off one of the biggest, quickest bull runs you’ve ever seen, likely followed by a huge correction even worse than what we are seeing now.

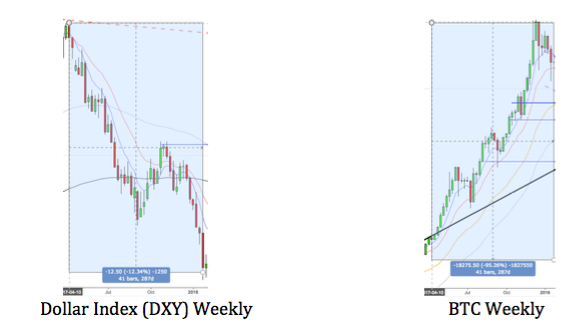

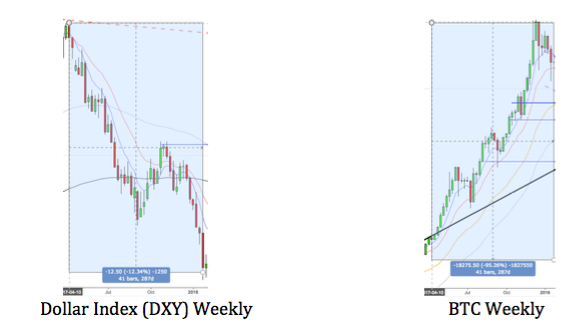

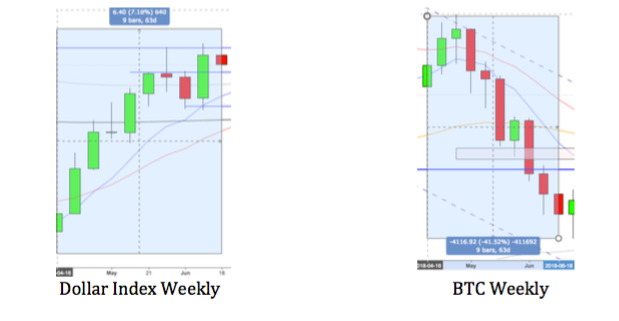

In order to distinguish a directional bias in the short term, there is a noticeable inverse correlation with Bitcoin and the US Dollar. The Dollar Index is an average, based on a basket of major currencies and indicates the overall strength of the dollar. So when the Dollar Index is in a bear trend, Bitcoin is bullish and visa versa.

From the 10th April 2017 the Dollar Index fell for a total of 287 days from 101.00 to 89.00 before consolidating then reversing. In the exact same period Bitcoin rose from $1200 to $20,000 before reversing at this level.

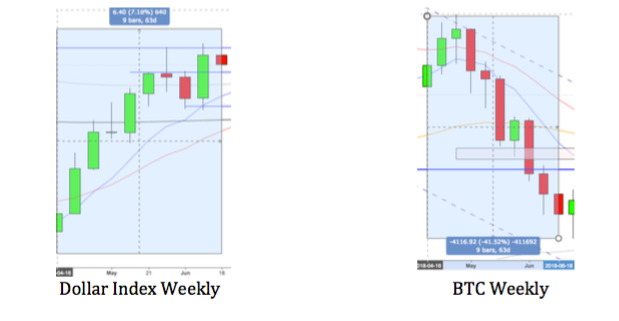

From the 16th April 2018 the Dollar Index rose in 63 days from 89.00 to 95.00 before consolidating. In the same period, Bitcoin fell from $9900 to $5800.

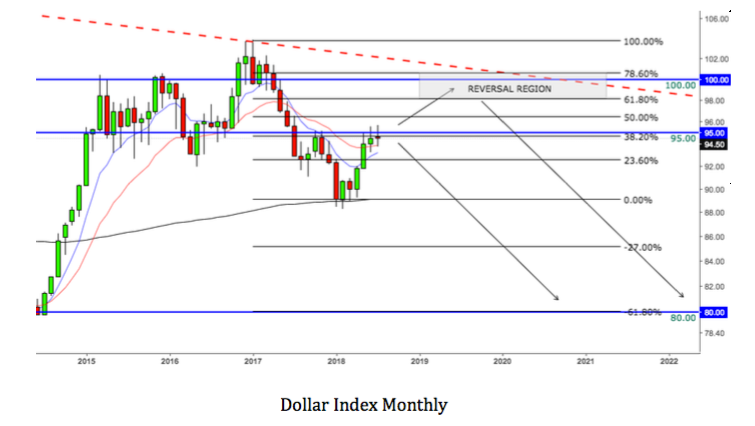

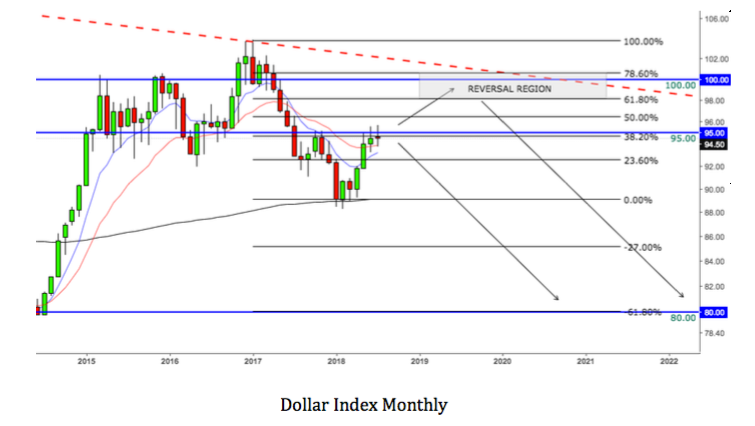

On a longer term perspective, the Dollar Index has hit the descending trendline for the third time and reversed quite violently from that region. Currently stalled below 95.00, this is a pivotal time for the Dollar Index as a break higher could result in a retest of 100.00 and the red dashed descending trendline where we could see another sharp reversal. The 100.00 resistance is aligned perfectly with the trendline. Technically we could break this trendline before continuing higher, but I personally believe the Dollar is in for a rough ride going into 2019. And could well be heading down towards 80.00.

Currently, as of writing on 25th June 2018, the Dollar Index has spent the last 10 months below 95.00 and has not been able to break above this psychological level. Having found support on the 200EMA (black) price drove back up into the 95.00 region, and there is now a potential Fibonacci setup in play which could see price drive up into the 61.8–78.6 region, which is nicely aligned with the descending trendline and the 100.00 resistance, if we see a drive up into those levels we could see a sharp decline into -27 & -61.8 on the Fibonacci which is perfectly aligned with 80.00. However, we could also see this reversal take place sooner if price does not break above the 38.2 on the Fib, which is perfectly aligned with 95.00 where price is currently stalling.

In summary, the smart money would only invest in a market while its climbing, rather than BTC when the price is falling. For BTC and the crypto market as a whole to really begin to flourish, we need to see weakness in the Dollar and in the stock market, which we are beginning to see the early signs of. The stock market hasn’t had a major correction since 2008 and it’s long overdue. Signs of the dollar becoming increasingly weak on a longer term technical perspective, are correlated with the fundamentals. A potential global trade war has already spooked investors and shown an impact on the markets already. In terms of BTC, until a clean break of $10,000 occurs we are still in a bear trend but this could change very quickly and weakness in other global markets will be the catalyst.

Peace

Danny Grant

A huge bull run in the crypto market is just around the corner, all of the foundations are being laid and the deals are being done with very little media attention as the elite allow the crypto mania to die down while getting ready to open their positions at their preferred prices. One thing is for certain, everything happening in the market is planned by the elite, there are groups of individuals who know exactly where the market is heading, and these are the guys who have had their money in one of the longest bull runs in stock market history, eventually a lot of this money will flood into crypto and kick off one of the biggest, quickest bull runs you’ve ever seen, likely followed by a huge correction even worse than what we are seeing now.

In order to distinguish a directional bias in the short term, there is a noticeable inverse correlation with Bitcoin and the US Dollar. The Dollar Index is an average, based on a basket of major currencies and indicates the overall strength of the dollar. So when the Dollar Index is in a bear trend, Bitcoin is bullish and visa versa.

From the 10th April 2017 the Dollar Index fell for a total of 287 days from 101.00 to 89.00 before consolidating then reversing. In the exact same period Bitcoin rose from $1200 to $20,000 before reversing at this level.

From the 16th April 2018 the Dollar Index rose in 63 days from 89.00 to 95.00 before consolidating. In the same period, Bitcoin fell from $9900 to $5800.

On a longer term perspective, the Dollar Index has hit the descending trendline for the third time and reversed quite violently from that region. Currently stalled below 95.00, this is a pivotal time for the Dollar Index as a break higher could result in a retest of 100.00 and the red dashed descending trendline where we could see another sharp reversal. The 100.00 resistance is aligned perfectly with the trendline. Technically we could break this trendline before continuing higher, but I personally believe the Dollar is in for a rough ride going into 2019. And could well be heading down towards 80.00.

Currently, as of writing on 25th June 2018, the Dollar Index has spent the last 10 months below 95.00 and has not been able to break above this psychological level. Having found support on the 200EMA (black) price drove back up into the 95.00 region, and there is now a potential Fibonacci setup in play which could see price drive up into the 61.8–78.6 region, which is nicely aligned with the descending trendline and the 100.00 resistance, if we see a drive up into those levels we could see a sharp decline into -27 & -61.8 on the Fibonacci which is perfectly aligned with 80.00. However, we could also see this reversal take place sooner if price does not break above the 38.2 on the Fib, which is perfectly aligned with 95.00 where price is currently stalling.

In summary, the smart money would only invest in a market while its climbing, rather than BTC when the price is falling. For BTC and the crypto market as a whole to really begin to flourish, we need to see weakness in the Dollar and in the stock market, which we are beginning to see the early signs of. The stock market hasn’t had a major correction since 2008 and it’s long overdue. Signs of the dollar becoming increasingly weak on a longer term technical perspective, are correlated with the fundamentals. A potential global trade war has already spooked investors and shown an impact on the markets already. In terms of BTC, until a clean break of $10,000 occurs we are still in a bear trend but this could change very quickly and weakness in other global markets will be the catalyst.

Peace

Danny Grant